blog

Shaping Tomorrow’s Cities: A Recap of the March 2025 CPDC Meeting

March's Central Philadelphia Development Corporation (CPDC) membership meeting — hosted by CPDC member Ballard Spahr — provided additional context for our Center City Housing Report and delved into a larger discussion on the opportunities and obstacles facing downtowns nationwide.

Following a discussion of the housing report led by Center City District (CCD)’s Economic Development Manager Lauren Smith, the presentation shifted to key highlights from CBRE’s Shaping Tomorrow’s Cities report led by John Stephens, Senior Director in CBRE’s Americas Consulting practice. The event concluded with a fireside chat between Stephens and CCD Vice President of Economic Development Clint Randall, placing Philadelphia’s strengths and opportunities in the context of this research.

Read along for some key takeaways from the reports, along with additional insights from the interview, and learn about how your organization can join CPDC.

Key Takeaways from the Housing Report

As noted in our newly released Center City Housing Report, Greater Center City accounted for 44% of all Philadelphia housing completions last year and is home to approximately one in eight residents while comprising less than 6% of the city’s total land area. Since 2019, more than 14,500 units have been added to Greater Center City. In 2024, it’s particularly noteworthy that nearly a quarter of all new housing units delivered citywide were within the 19123 ZIP code alone.

With this new housing supply comes the question of residential demand. While the citywide population grew by just 0.2%, core Center City’s population increased by 3% according to anonymized cellphone data from Placer.ai. Occupancy in core Center City’s apartments has held steady at 92% and positive net absorption indicates continued demand. Extended Center City apartment occupancy declined over the course of 2024 to 83%, a reflection of unprecedented levels of new supply hitting the market in a short timeframe. A slowdown in construction and new deliveries will allow these temporarily over-supplied neighborhoods to play catch-up.

Shaping Tomorrow’s Cities

The Shaping Tomorrow’s Cities report explores 19 city markets, grouping them into four archetypes based on scale, concentration and location of their density: super cities (Los Angeles and New York), mixed majors (Philadelphia, Seattle, Boston, Washington), sprawling darlings (Sun Belt markets), and developing destinations (Austin, Tampa, Orlando). Sprawling darlings like Houston and Atlanta had much wider commuting areas, while most mixed majors trended towards having a strong central business district that is home to a majority of their jobs. Philadelphia and its mixed major peers are all older cities, laid out before cars, and as such their built environments, development patterns, and infrastructure share similarities.

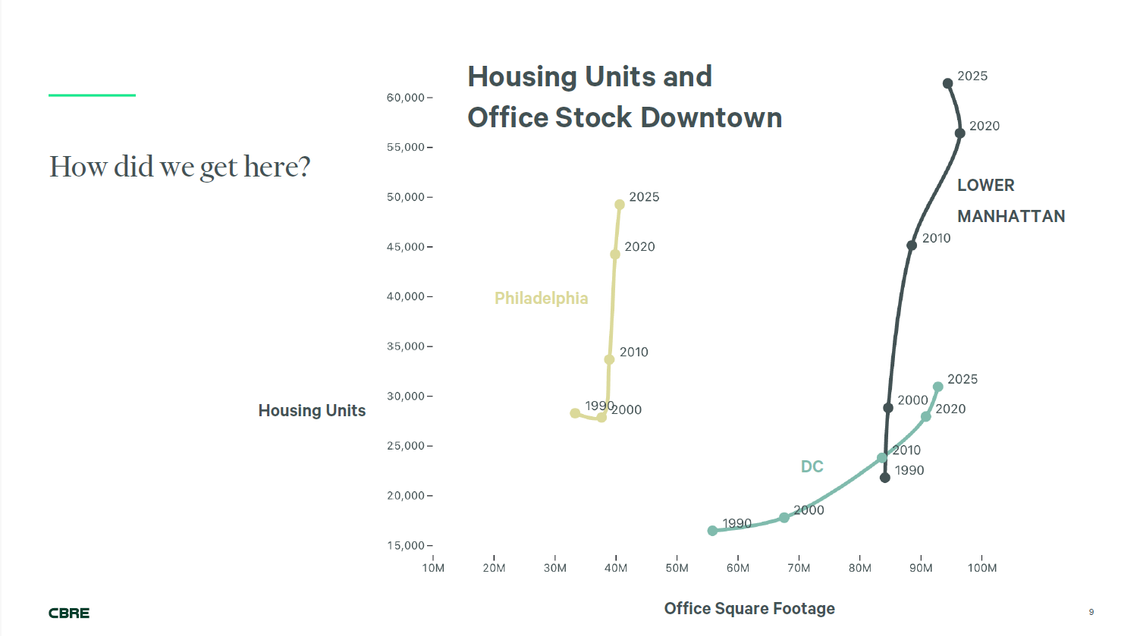

While downtowns are experiencing a “flight to quality,” Philadelphia is notable in that there is a high quantity of vibrant mixed-use properties, where trophy-class properties are surrounded by retailers and restaurants, and vibrant residential, walkable neighborhoods. Historically, this connects to Philadelphia’s growth since 1990, where office stock has remained static — due to older office properties being converted as new spaces were built — while housing has grown dramatically. Philadelphia is unique among mixed majors in both the amount of vibrant mixed-use areas its downtown has, but also in its unchanged office inventory over decades.

The Intersection of Transportation and Cities

Infrastructure — especially legacy public transportation systems — is one of the other common traits between the mixed majors. As Stephens pointed out, “transit access is one of the best proxies for location value that could be spread across everywhere.”

For corporations looking to occupy spaces in cities, it’s still a priority, but the convenience of transit systems has also become a larger factor thanks to workforce advancements such as hybrid work. Many workers on hybrid schedules are more willing to tolerate a longer commute since they’re not traveling to the office five days a week.

Meanwhile, our systems were built for five-day-a-week commuting. Cities outside of the U.S. serve as an inspiration for what could be, as they have more effectively built systems more focused on traveling place-to-place instead of a “get to the hub”-type system while simultaneously creating positive experiences for their passengers.

You Can’t Convert Your Way Out

While office conversions have been discussed as a way to solve for the surplus of office stock available, it’s not a silver bullet.

Cities like Philadelphia and Cleveland have led the way in conversions — especially to residential uses. However, Stephens said it’s time to start thinking more creatively: “One of the mindset shifts taking place is not thinking about the only way to do an office conversion is installing the apartments inside the office building as it exists today like a tenant fit out, but thinking more creatively about how we can use this asset in whatever shape it is in to be something new tomorrow.”

For properties, that may mean partial conversions, where larger buildings that may not be appropriate for entire office-to-residential conversions instead become vertical mixed-use destinations with a blend of hotel rooms, lifestyle amenities, residential condos, and potentially some office spaces, all in one building. While not as straightforward as a single conversion, and not as easy from a financing perspective, this type of unifying vision offers additional opportunities and ways to engage prospective tenants.

This is relevant today as cities need to evolve into what the communities they serve need. In Washington, office space was a dominant use of the central business district because it’s what was needed for the time. Meanwhile, Center City’s office space has remained consistent while housing has greatly increased.

To supplement this, investments in the public realm are key to better attracting these populations. Farmer’s markets and outdoor programming can successfully engage residents and workers, but tailoring these efforts to the needs of the community is important. Additionally, proper management of spaces — through clearly visible cleaning and safety efforts — is paramount.

Learn more about Philadelphia’s performance compared to other U.S. markets in CBRE’s Shaping Tomorrow’s Cities report.

How You Can Get Involved

We thank CPDC member Ballard Spahr for hosting this quarter’s membership meeting, and CBRE’s John Stephens for taking the time to join this discussion.

Interested in hearing the perspectives of other business leaders? Learn how you can become a member of the Central Philadelphia Development Corporation and attend our member-only panels.