digest

Center City Digest, Fall 2017

The Fragility of Revival

“Is city growth slowing?” That’s the question urban demographer William Frey asked last May after analyzing recent census data for major metro areas.1 In the last seven years, cities have outperformed both their suburbs and the national economy in job growth as they bounded back from the Great Recession.

Population data too, had suggested cities were outpacing their suburbs, perhaps signaling the reversal of 70 years of sprawl.

In this issue

- The Fragility of Revival

- One Small Act of Kindness at a Time

- As the Rail Park Moves to Completion, Become a Part of Its Success

- CCD and PRMA Launch Campaign to Promote Shopping

- Major Landscape Updates During the Summer

Some proclaimed this the century of the city, conflating rapid third-world urbanization with North American city center revival. Others asserted the corollary: the suburbs are over. But even in 2010, skeptics suggested millennials and others might simply be deferring home purchases due to job uncertainty and doubts about long-term appreciation of suburban prices. After all, many millennials watched their parents experience a painful loss of value in their primary assets.

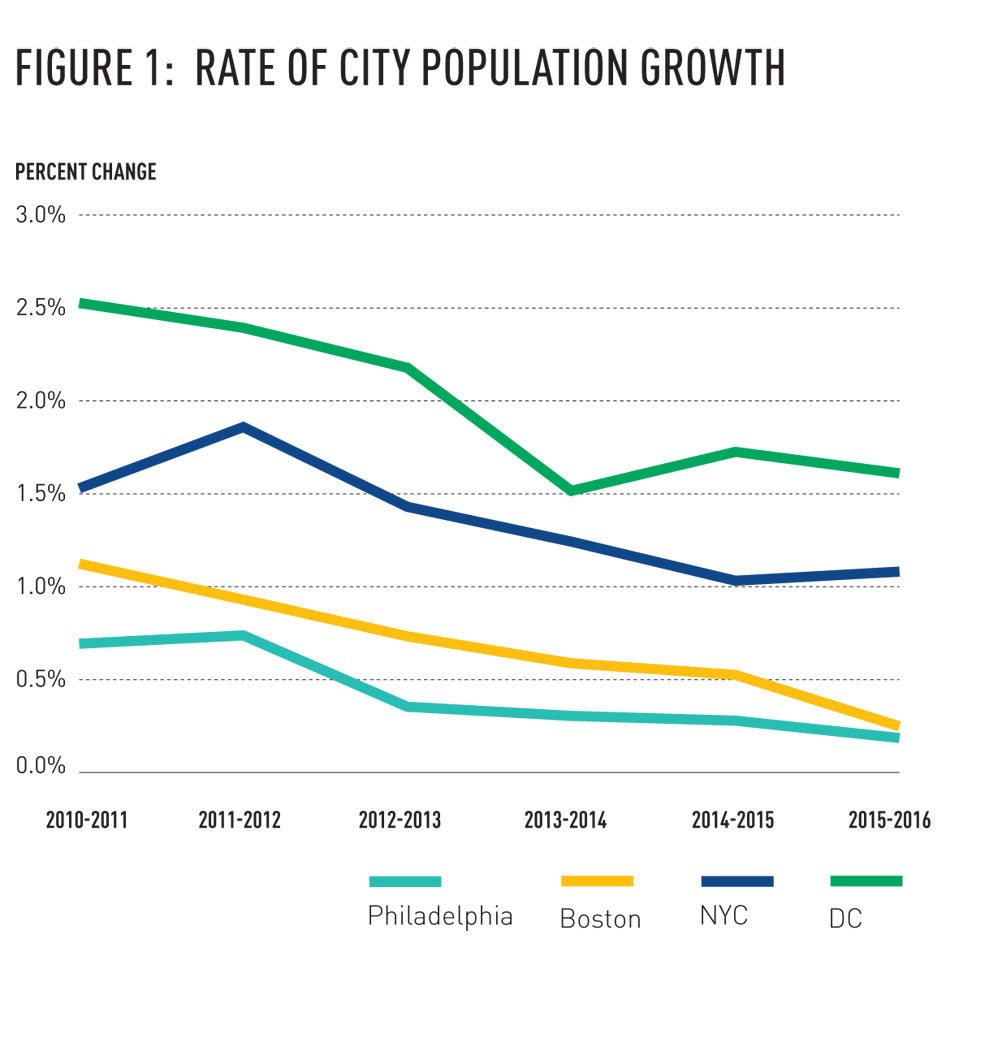

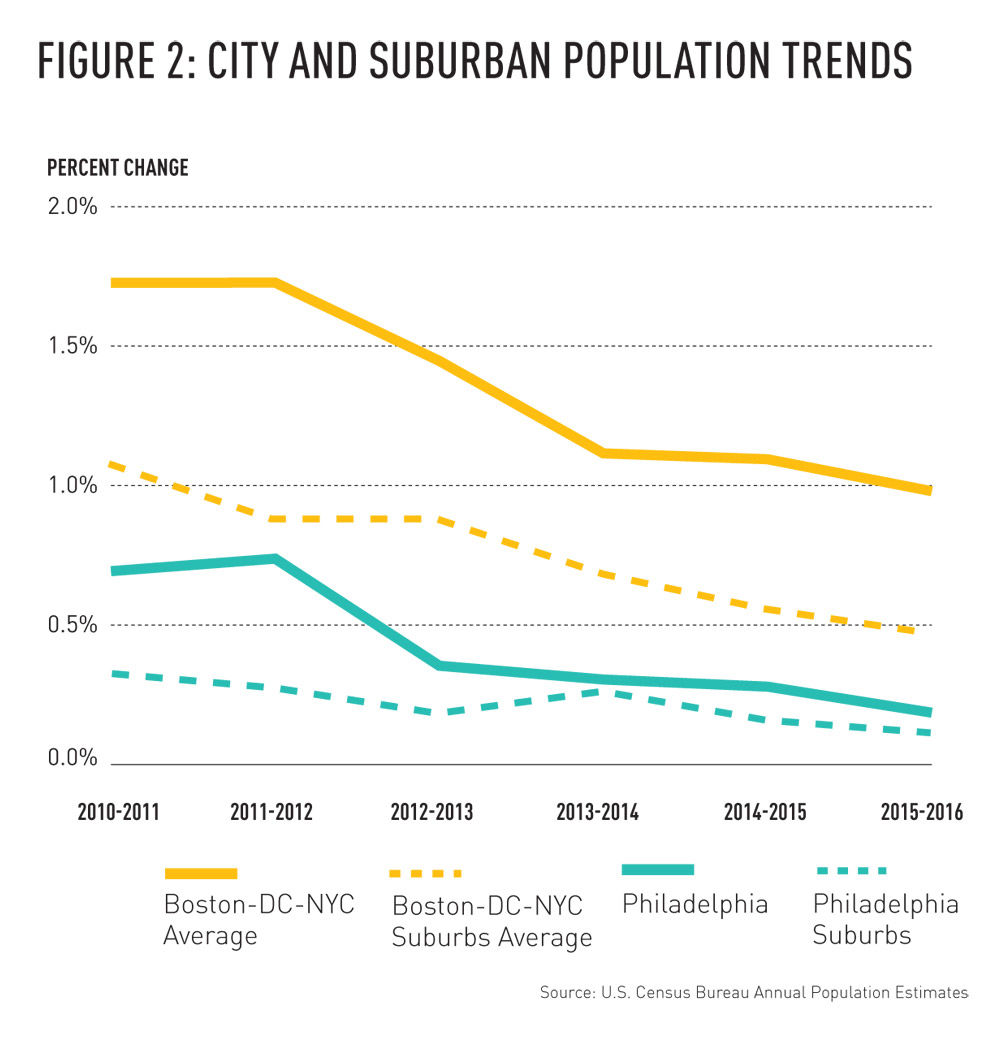

In new data for the period 2011 to 2016, Frey detected a distinct slow-down in urban population growth that ought to give us pause (Figure 1). Already in 2010, population was rising more slowly in Philadelphia than in Boston, New York or Washington. Philadelphia’s rate of growth is also converging more quickly than our peers with suburban trends, limiting our ability to regain market share (Figure 2).

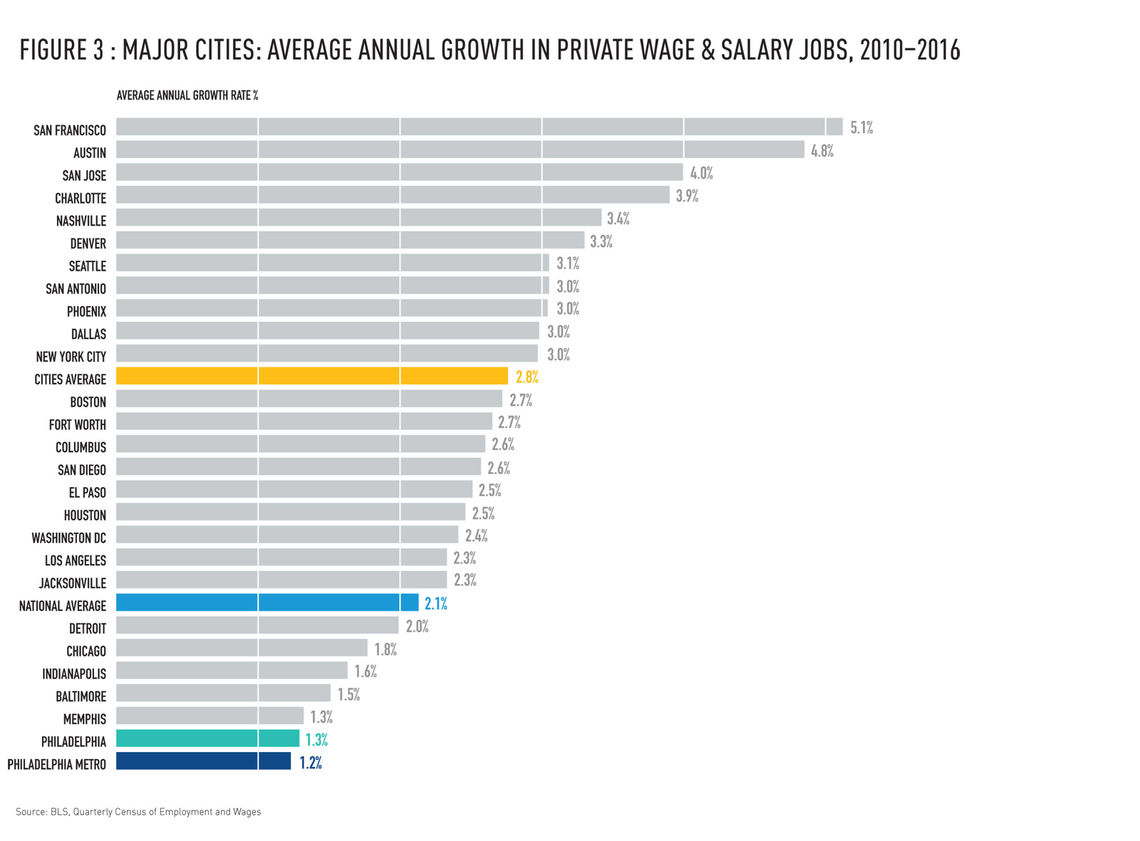

Note however, we are not looking at decline, just the deceleration of growth in both the city and region. Further, these findings come from limited sampling by the Census Bureau, so it’s best to wait for the 2020 census to be sure. Still it’s a caution flag, especially since Philadelphia long trailed the 25 largest cities in job growth, too (Figure 3).

Growth in the Core

The remarkably positive revitalization of Center City and University City is grounds for great optimism. It’s a strong selling point for business, large and small: a highly-diversified, downtown economy; a well-educated workforce; 40% of residents ages 20 to 34; dense, walkable and more affordable than our peers. This appeals to local start-ups and existing firms, to suburban firms deploying clusters of workers in coworking space and to those signing larger, more traditional leases. It’s key to the narrative being crafted for Amazon.

But success in the 10 square miles of Center City and University City is offset by persistent, older trends in much of the other 92% of the city’s geography, a primary reason why we lag our peers and have the highest poverty rate among major cities. These are disparities that consume our politics.

Consider: 37% of those who moved into Philadelphia since 2010 chose the amenity- and job-dense, live-work locales of Center City and University City. But from 2010 to 2016 the city as a whole was still net-negative in the region: 62,000 more residents decamped for the suburbs than moved in, with twice as many migrating to Montgomery County as came our way. Immigration and local births kept us population positive, augmented by millennials and empty nesters flocking to the center.

These last two age cohorts are profoundly beneficial to labor and housing markets, to consumer demand and on-street vitality. But both are time-limited surges, demographic trends that will run their course. So the real work is not the facile, promotional messages celebrating the incoming millennial tide; it’s the lowering of barriers that limit our ability to accelerate and lock-in for the long-term these recent gains; it’s expanding opportunity and revival citywide.

Signs of Fragility

- Scores of successful public schools with parents deeply engaged. Uncertainty about long-term reliability of sufficient funding.

- 25% of Philadelphia residents living outside Greater Center City take transit to their jobs downtown; but 40% of their neighbors commute to the suburbs. Find a home nearby and these reverse-commuters get better funded schools and an automatic pay raise, slipping out from under Philadelphia’s wage tax.

- Waves of millennials are reshaping public spaces and favoring two wheels over four. But a cultural cold-war over modes of mobility is hard to resolve when transportation management is fragmented among multiple entities, most lacking the resources required for the job.

- Outdoor cafes are up 383% in the last 16 years. But homelessness and panhandling are reaching record highs, as the fiscally-constrained Kenney Administration still seeks the right balance between services for those in need and a constitutional and politically-acceptable means to ensure standards of civility in all public spaces. Problematic behavior among some of the 500 people living on Greater Center City sidewalks weighs heavily on the perceptions of 300,000 workers, 188,000 residents and several million visitors and shoppers who have many options elsewhere.

Encouraging Signs

- In CCD’s reauthorization process this summer, there was overwhelming support for the proposed, new five-year plan. Just one owner of two smaller buildings out of 1,688 benefitting properties in the District formally objected. For 2018 to 2022, CCD’s supplementary assessments will be devoted to clean and safe seven days a week; to market research and the promotion of restaurants and shops; to landscaping, lighting, signs, trees and new streetscape enhancements; to ongoing improvements and programming in four CCD-managed parks; and to leveraging grants and contributions to create the new Rail Park.

- The pursuit of Amazon, win or lose, brings together economic developers, businesses, residents, elected officials, students and even architectural critics, to assess our strengths and challenges, highlight needed infrastructure investments and forge good habits of working collaboratively for regional gain.

By all means, pursue Amazon with its potential for up to 50,000 new jobs by 2027. But as with millennials, it’s no silver bullet. Resist the temptation to rely only on one-off inducements that cut more holes in the Swiss cheese that is our business tax structure. “Urban economies aren’t really built by winning a contest,” Bruce Katz of Brookings recently wrote, “they are grown methodically by building on a region’s strengths … the race for long-term prosperity isn’t defined by the months-long sprint to lure $5 billion of investment from Amazon; the real game is the marathon” in which cities capitalize on their strategic assets.

Pursue Amazon, but stay focused on across-the-board, more equitable tax reform. Stay focused on quality-of-life issues too. Create a climate where all businesses grow, opportunity expands and the local tax base broadens to fund the quality schools and services this city needs.

An econometric analysis of the impact of the Philadelphia Jobs Growth Coalition plan to reduce wage and business taxes projected 75,000 new jobs in the next 10 years.But who believes these models? So try this: Philadelphia’s economic growth has been the slowest among the top 25 American cities. If we simply got to be average, growing at the mean rate of the 25 largest cities, Philadelphia can add 190,000 more jobs by 2027. That’s real revival.

Paul R. Levy

President

plevy@centercityphila.org

1: William H. Frey, “City Growth Dips Below Suburban Growth” Brookings Institution, May 30, 2017

2: Bruce Katz, Brookings Institution blog, September 25, 2017

3: www.philadelphiagrowthcoalition.com