CCD Assessments

How does the CCD calculate its charges?

The CCD is an independent authority organized under the Commonwealth’s Municipality Authorities Act (“the Act”) that has procedures for assessment that are different from those of the City of Philadelphia. While the City’s real estate taxes and the CCD’s assessments both start from the assessed value of real estate as determined by the Office of Property Assessment (OPA), the Act requires CCD to use a property’s assessed value for taxable purposes, as determined by OPA, and to calculate an individual property’s charge by determining its proportionate share of the total assessed value of the District and multiplying that fraction times the CCD’s approved annual operating budget.

How did the OPA arrive at its valuation which the CCD used to calculate my bill?

Based on its legal responsibility to set values for all properties, the OPA, calculated a market value for your property which serves as the basis for the assessment that we used to calculate your bill. If you have further questions as to how the OPA arrived at your assessment, please contact them directly at 215.686.4334 or at https://www.phila.gov/OPA/Assessments/Pages/Appeals.aspx.

My assessment is under appeal or has been reduced on appeal; is this reflected in my CCD Assessed Charge bill?

In November or December each year, the CCD receives from the OPA market value and assessment data for each property in the District that is used to calculate charges for the coming calendar and billing year. If you received a reduction on appeal from the City of Philadelphia and believe that the value as noted on the CCD Assessed charge bill is incorrect, please contact us so that we can review your information and/or make appropriate adjustments if required. If your property is currently under appeal, but no decision has been made by the City, we ask that you contact CCD directly so that we can keep track of the appeal, as receipt of data from the City is not always timely. Once we receive the final value determination from the City, we will make any necessary adjustments to your CCD Assessed Charge bill. For questions regarding your assessment or to notify us of your pending appeal please contact our Director of Billing and Collections Services, Curts Charles at 215.440.5570, or ccharles@centercityphila.org.

When is my charge due?

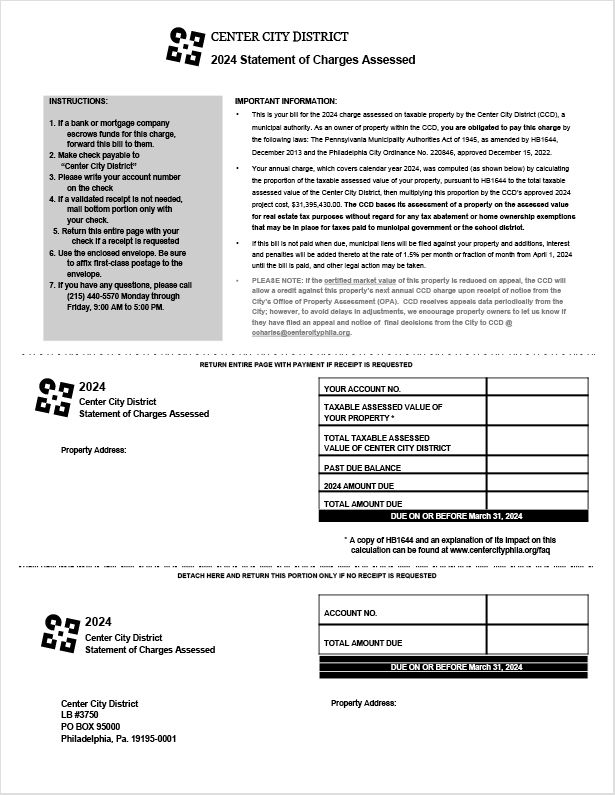

Your charge is due no later than March 31, 2024. After this date we may charge interest and penalties on the outstanding balance until your charge is paid. Charges to condominiums within the CCD are payable to the Condominium Association.

I haven’t received my bill. What should I do?

The 2024 Statement of Charges for the Center City District were mailed out on February 1, 2024. If you have yet to receive a statement and would like a copy emailed to you directly, you can submit a request at ccharles@centercityphila.org and cc assessments@centercityphila.org.

Why isn’t the property owner across the street charged? What are the boundaries of the CCD?

Every property owner with a taxable property assessment within our District boundaries receives a CCD bill. It could be that property owner across the street or on the next block is outside of our boundary. To view our District boundaries, visit the CCD Boundary Map page.

What sort of problems can you help with?

Please contact us if you see any problems in the public environment that affect the safety, cleanliness, quality of life or attractiveness of your neighborhood. Even if the resolution is not the responsibility of the CCD, we will work with the appropriate agency to take care of the problem.

What do I do if I notice graffiti outside or another problem? Who can I call?

Please do not hesitate to contact our office to report your issue. We will be happy to take down the information and make sure that your problem gets addressed. You can reach us at 215.440.5500 or email us at info@centercityphila.org.

How can I stay informed about what’s going on in Center City?

As a property owner in the District you will receive our quarterly print newsletter, Center City Digest. You can also sign up for (IN) Center City, our free email newsletter. The newsletter contains information about arts and cultural events, shopping and dining, discounts and more.

Our website is also a great resource to learn about everything going on in Center City and includes information about our services, reports on downtown market trends and issues, and connects to many other helpful websites.

What benefits do I receive because I live within the CCD?

You live in the best maintained and managed area in Philadelphia. While municipal government cleans the streets and empties trash cans, your yearly assessment supports daily sidewalk cleaning a minimum of three times a day plus periodic pressure washing in the warmer months; graffiti removal from the ground floor of building facades, street poles, traffic boxes, and street signs; the deployment of uniformed public safety ambassadors, Community Service Representatives (CSRs) and a Bike Safety Patrol who work in partnership with the Philadelphia Police Department; a homeless outreach team who connect homeless individuals with available services; physical improvements such as improved lighting, signs, and landscaping; special events and promotions, such as Restaurant Week, and much more. To learn more about the CCD’s programs and services, please visit the CCD Services page. CCD’s assessment revenues are used exclusively to fund services and physical improvements within the boundaries of the CCD.

How is my charge calculated?

Your annual charge is set by Commonwealth and City law and calculated by a formula that applies to all taxable properties, without regard to abatements, homestead exemptions and other exemptions provided by the City of Philadelphia. The following explains the CCD methodology to calculate the assessed charges for commercial and residential properties.

In 2012, a change to the Commonwealth’s Municipality Authorities Act (the state law that governs the CCD) enabled the District to reduce by 50% the charges that are levied on residential single-family, cooperative and condominium properties. The Commonwealth’s HB 1644, which was signed into law in December 2013, further permits the CCD to use the same 50% formula authorized by the 2012 amendment, but adds the objective that the total assessed value of residential owner-occupied properties will not exceed 5% of the CCD’s annual assessed value in any year. To this end, all non-residential assessments include a small, proportionate allocation to ensure that the total assessed value of residential owner-occupied properties does not exceed 5% of the CCD assessment budget. To access HB 1644 Act 128 as approved, click here.

To view how residential and commercial assessments are calculated, please click here.